LUMPSUM INVESTMENT MANAGEMENT

“I have a lump sum of around Rs. 7.5 lakhs. I want to invest it in equity. Looking at the growth in 2020 - 2021, I'm very sceptical if there's any potential for growth in future years. Which stocks (large cap, mid cap, small cap) should I invest in, what sectors should I target, what should be the weightage of each stock and each sector, how diversified should my stock portfolio be, what should be the entry and exit plan, where are we in the market cycle, what is the maximum drawdown, what could be the return on investment etc.?” Let the qualified person deal with such questions for you. You have lump-sum cash sitting idle with you? Invest and let the money work for you.

WHY HIRE EXPERT?

Investment is most intelligent when it is most businesslike. Managing investments is a full-time profession and let professionals handle your money. If you are a conservative investor, your portfolio will have large cap/blue chip companies. Moderate investors will have multi cap companies and so on (refer 'Portfolio types' section for more details). Portfolio is tailor-made to cater to patrons’ specific investment objectives.

HOW?

Under this offering, investor’s account will be kept separate and operated according to his/her investment mandate, where an investment manager takes all decisions in-sync with investor’s goals. The higher transparency and regular reporting as compared to mutual funds are also plus points. Stocks are bought and sold in investor’s demat account.

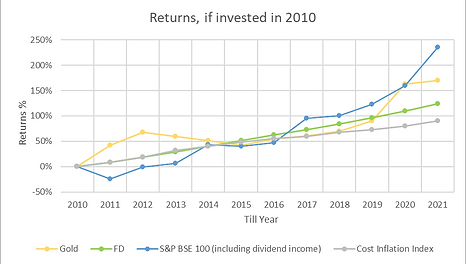

ANALYSING THE PAST

The equity market has long been considered the source of the greatest historical returns for investors, outperforming all other types of financial assets and the housing market over the past century or so. But whether stocks are the best investment also depends on important factors like the time frame you choose to look at, investor's own investment horizon and a professional approach in managing investments. Let’s look through and compare the historical returns from various class of assets and give grounds on why equities is substantiated as a best class of asset to beat inflation and create wealth in the longer run.

Below data charts analyse and compare the returns from various asset classes (including the inflation index) in case of a lumpsum investment for several time frames from duration thru 10 years, 11 years, 15 years, 16 years, 26 years and 41 years across previous 4 decades. It is clearly evident that, chose any time frame, any duration, in maximum timeframes, returns from equity has always outperformed other asset classes and beat inflation by a very high margin.

Important note – Returns from equity below represents returns from ‘S&P BSE 100’ index which is over diversified. With stock specific approach if equity investments are managed professionally, one must get higher returns than the index under consideration.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

If your only reason for picking a stock is that an expert likes it, then what you really need is paid professional help

"Peter Lynch"

STOCK SIP MANAGEMENT

"I am keen to invest in stocks for the long-term by buying into a basket of stocks at regular intervals’’ OR ‘’Lump-sum investments are a bulk commitment. I am hesitant to pump in large amount in one-go’’. Stock SIP is a suitable solution. It enables investors to buy stocks (amount/quantity based), periodically (weekly, monthly, etc.) in a systematic manner. It is the best way to participate in equity market for retail investors.

Stock SIP is an easy and flexible method of investing in stocks. It is the ideal method of investing for long term investors to create long-term wealth by investing in a disciplined way. It helps you to make the best of the unpredictable market by adopting a disciplined investment strategy. Like SIPs in mutual funds, investors can also use the Stock SIP route during uncertain times to beat market volatility.

WHY HIRE EXPERT?

Stock SIP is not a sure success formula. If you buy the wrong stocks, you won’t make money. It works better for stock pickers. If you start SIP with stocks that has been in the downward direction, you will lose money whereas if you SIP winning stocks you will make money. The challenge is to identify them ahead of others. No investor gets all his bets right. So, one must diversify. If you go the Stock SIP way, you will have to enrol for multiple stocks.

It’s crucial to note that SIP format of investing is very different from lump sum investment. Lump sum investment fluctuates as per the market movements. On the other hand, SIP investment averages the cost over time. A portfolio managed from lump sum investments cannot be applied in Stock SIP since lump sum investing approach tends to do well in a rising trend. However, you need a superior approach in choosing the blend of stocks for Stock SIP to make the best of the power of rupee cost averaging.

WHY STOCK SIP IS A BETTER OPTION?

Mutual fund is also a great option to do SIP. But “How to identify funds to help achieve my financial goals, how should I allocate my SIP across various funds, what is ideal exit plan from each fund, what could be the return on investment in mutual funds?”

Before you invest in mutual funds, you should do your homework. There is no guided path to identify, analyse and subsequently manage a mutual fund investment. You need to develop your method to do that. Investors need to note that there is a huge variety of mutual funds and that even investment in funds requires some preliminary research and thinking. The investor must examine the objective of the fund and see how closely it aligns with what you have in mind in terms of both risk and return. So while it is true that a fund makes the job easier for an ordinary investor, enough background work needs to be done to pick the right one.

However, in professionally managed Stock SIP all you need to do is invest, everything else is handled by the expert. And fortunately, we're here to help you with that!

HOW?

Like in lump sum investment, Stock SIP is operated and managed in client’s account where an investment manager takes all decisions in-sync with investor’s goals. The higher transparency and regular reporting as compared to a mutual fund are also plus points. In the same way, portfolio is tailor-made to cater to patrons’ specific investment objectives.

WHAT ARE THAT MANY BENEFITS OF STOCK SIP?

-

Easy and flexible format of investing in stocks. You have a choice to invest in different stocks every month depending on the prevailing market cycle hence you need not have a fixed portfolio OR retain the SIP amount for few months when the prevailing market scenario is inappropriate for investments and eventually invest the same in whole or in portions when it’s the right time to buy stocks. This way you are always open and convenient to pick the beaten down stocks but at the same time ensuring to build a smart portfolio without over diversification. This method has proven to achieve huge returns compared to usual SIPs by a very wide margin.

-

Harness the power of rupee cost averaging and the power of compounding.

-

Works in both bull and bear markets and impact of market volatility is reduced. Stock SIP also helps by avoiding the risk of buying shares at a higher price. They are ideally meant for long-term investors.

-

Simple and disciplined approach towards investment without having to worry about timing the market and protect oneself during volatile times.

-

Long-term financial goals can be met with Stock SIP.

-

Makes the investment process more disciplined by taking out speculative component out of the investment process.

ANALYSING THE PAST

Let’s extend our comparison of the historical returns from various class of assets in SIP format too and substantiate why equities are the best class of assets in this format of investing as well.

Below data charts analyse and compare the returns from various asset classes (including the inflation index) in case of a SIP(Systematic Investment Plan) starting with Rs. 10,000 per month followed by 10% increase in SIP amount every year. Analysing for several time frames from duration thru 10 years, 11 years, 15 years, 16 years, 26 years and 41 years across previous 4 decades. It is clearly evident that, chose any time frame, any duration, in maximum timeframes, returns from equity has always outperformed other asset classes and beat inflation by a very high margin.

Important note – Returns from equity below represents returns from ‘S&P BSE 100’ index which is over diversified. With stock specific approach if equity investments are managed professionally, one must get higher returns than the index under consideration.

%20SIP.png)

%20SIP.png)

%20SIP.png)

%20SIP.png)

%20SIP.png)

%20SIP.png)

%20SIP.png)

%20SIP.png)

Saving money is wise, but investing it is profitable

"Anonymous"

.png)

MARGIN

TRADING

-REQUIRES HIGH CAPITAL

-INVOLVES MEDIUM RISK & HIGH RETURNS

-Execution of systematic trades with the support of in house semi algorithm (semi automatic) based application which is developed by a professional IT company.